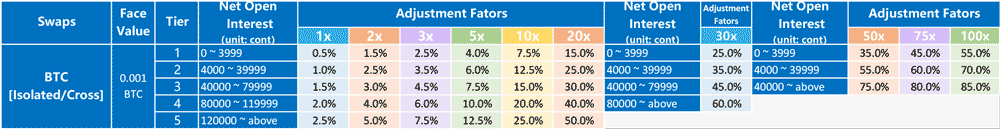

The adjustment factor is designed to prevent users from extended margin call loss. Huobi USDT-margined Swaps uses a tiered adjustment factor mechanism, which supports up to five levels based on the position quantity. The larger the use’s net position, the higher the level and the greater the risk.

- As a example for BTC:

[searching adjustment factor of more trading pairs]

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

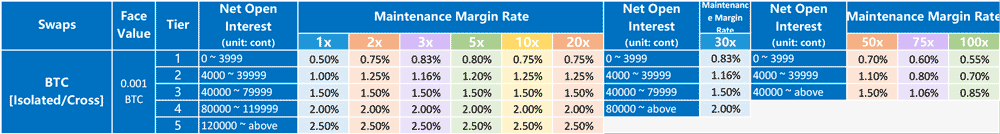

Maintenance Margin Rate = Adjustment Factor / Leverage(This data is for reference only and is not used as a basis for liquidation)

- As a example for BTC:

[searching maintenance margin rate of more trading pairs]

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

For example, if a user chooses 10x leverage ratio:

With long positions of 12000 conts and short positions of 30000 lots of BTC/USDT swaps contracts; The net position should be 18000 conts; Corresponds to adjustment factor of 12.5%.