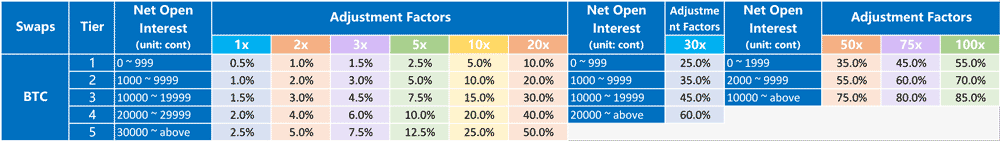

The adjustment factor is designed to prevent users from losing margin calls on the system. Huobi Futures uses a layered adjustment factor mechanism, which supports up to five levels most depending on the currency. When the user's net position is high, he / she will be in a higher adjustment factor coefficient and has a higher risk.

Note: The face value of BTC contract is $100 USD/cont, other altcoin contract is $10 USD/cont.

- As a example for BTC:

[searching adjustment factor of more trading pairs]

【The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.】

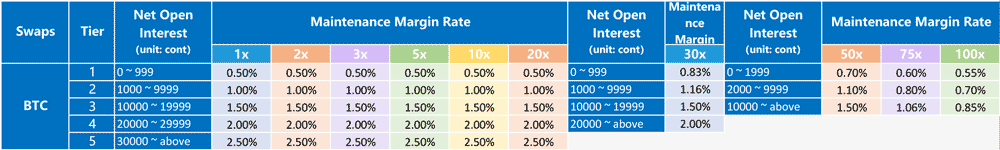

Maintenance Margin Rate = Adjustment Factor / Leverage(This data is for reference only and is not used as a basis for liquidation)

- As a example for BTC:

[searching maintenance margin rate of more trading pairs]

【The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.】

For example, if a user chooses 10x leverage ratio:

With long positions of 1200 lots and short positions of 3000 lots of BTC Perpetual swaps contracts; The net position should be 1800 lots ( 1 BTC contract = 100usd/ lot ) ;Corresponds to adjustment factor of 10%.