A trailing stop order allows users to place a preset order on the condition that a larger callback occurs. When the market price of a contract meets both the activation price and the callback rate set by users, the strategy will be triggered to place a limit order by using the preset price (Optimal N or Formula price). It is always used for buying when the market rebounds from the bottom or for selling when the market price pulls back from a high point.

Description of parameters:

Activation Price: one of the conditions to determine whether a strategy will be triggered. It is required as below:

| Direction |

Requirement |

| Buy |

The activation price < The latest price. |

| Sell |

The activation price > The latest price. |

Callback rate: one of the conditions to determine whether a strategy will be triggered. The callback ratio shall be greater than 0% and less than or equal to 5%. The precision is accurate to 1 decimal place, such as 1.1%;

Amount: the quantity of the limit order that is to be placed after a strategy is triggered;

Order price type: the price type of the limit order that is to be placed after a strategy is triggered, such as Optimal N, Formula Price;

Direction: the buy/sell direction of the limit order that is to be placed after a strategy is triggered;

Formula price: one of the price types that could be used to place a limit order after a trailing stop order is triggered, which is calculated based on “The lowest price * (1 + Callback rate)” or “The highest price * (1 – Callback rate)”;

The lowest/highest price: the lowest/highest market price from the setting of a strategy to a strategy being triggered.

Trigger conditions:

The conditions below shall be met at the same time:

| Direction |

Condition 1 |

Condition 2 |

| Buy |

The activation price ≥ The lowest price |

The lowest price * (1 + Callback rate) ≤ The latest price |

| Sell |

The activation price ≤ The highest price |

The highest price * (1 - Callback rate) ≥ The latest price |

Example:

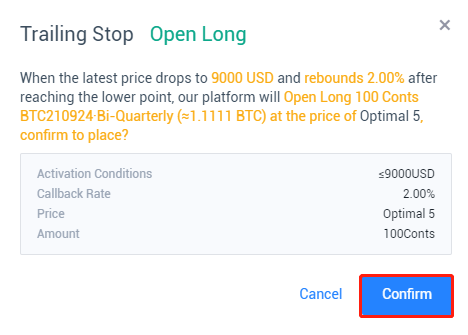

Assume the market price of BTC bi-quarterly contracts is 10,000 USD. Tom judges that the market price will continue to drop and may rally after slipping to a certain point. Tom predicts the price may fall to 9,000 USD and wishes to buy 100 conts of long position at the price of Optimal 5 when the callback rate reaches 2%. Hence, he places a trailing stop order with parameters below:

Activation price: 9,000 USD;

Callback rate: 2%;

Direction: Buy;

Order price type: Optimal 5;

Amount: 100 conts.

Then when BTC bi-quarterly contracts price declines from 10,000 USD to 8,800 USD, the lowest price 8,800 USD is lower than the activation price 9,000 USD, which meets the trigger condition 1. If the price rebounds to 9,000 USD soon afterward, the formula price calculated by using the callback rate “8,800 * (1 + 2%) = 8,976 USD” is lower than the latest price 9,000 USD, which meets the trigger condition 2. As a result, the strategy is triggered and the system will help buy 100 conts of a long position at the price of Optimal 5.

Order Method:

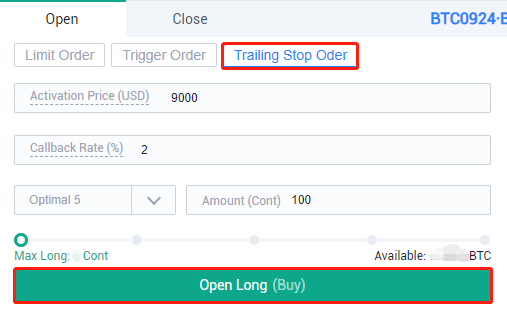

Click “Trailing Stop Order”, set an activation price of 9,000 USD and the callback rate of 2%, enter the amount of 100 conts, choose “Optimal 5” price, then click “Open Long” to place the order.

Notes:

1. The trailing stop order feature is only available for contracts in trading status;

2. To place a trailing stop order, the order amount entered shall not exceed the limit of the order amount to a certain asset;

3. Before a trailing stop order is triggered, the user’s margin or positions will not be frozen. Only when the order is placed successfully, the margin or positions will be frozen;

4. When a trailing stop order is triggered to close a position, and the positions available to close is less than the order amount, the system will place an order based on the positions available to close;

5. Trailing stop orders may fail to be triggered due to price limits, order amount limits, position limits, insufficient margins, non-trading status, network issues, or other system issues.

6. Once a trailing stop order is triggered, it will be the same as an ordinary limit order. It would be placed with the preset conditions and might fail to be filled, that is, when the selling price is lower than the market price or the buying price is higher than the market price, the order will be filled at the market price. Please note whether the order can be successfully filled or not wholly depends on the market conditions.