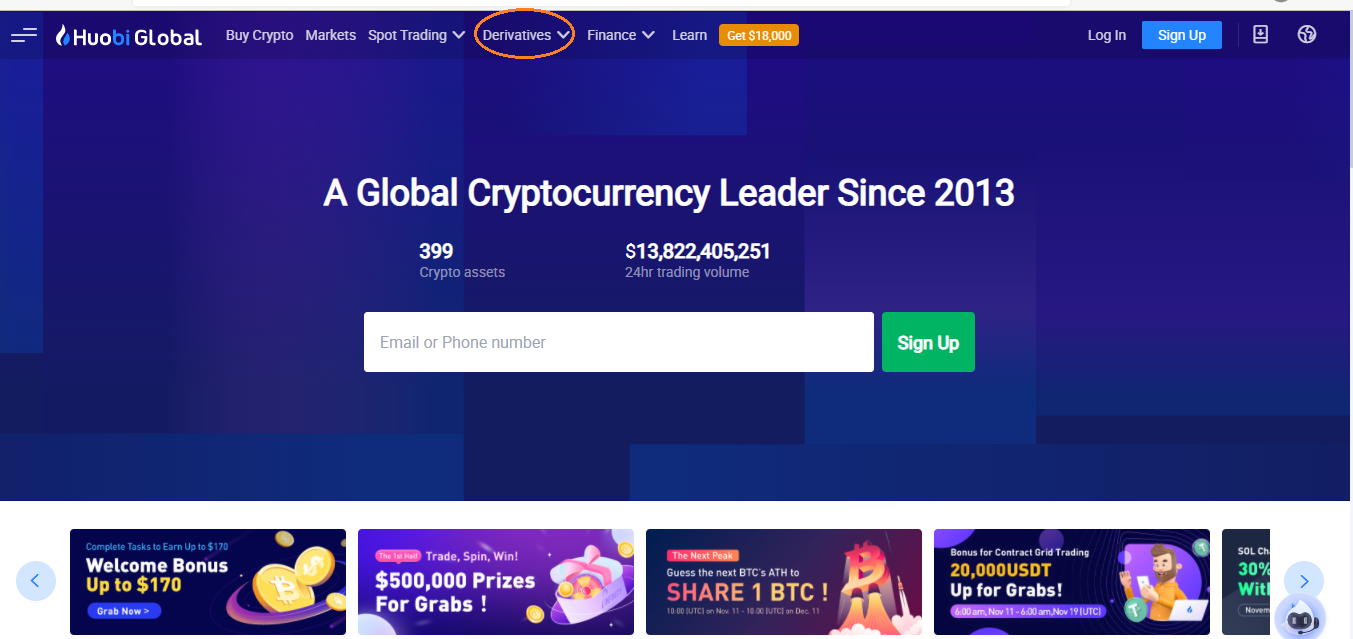

1. Visit "https://www.huobi.com/en-us/“, click " Derivatives ".【Don't have Huobi Futures account yet? Please check>>>】

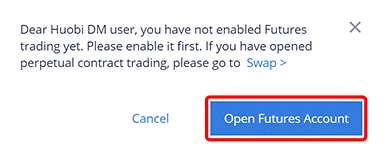

2.The system will prompt you to open Derivatives trading service when you log into Huobi Futures for the first time.

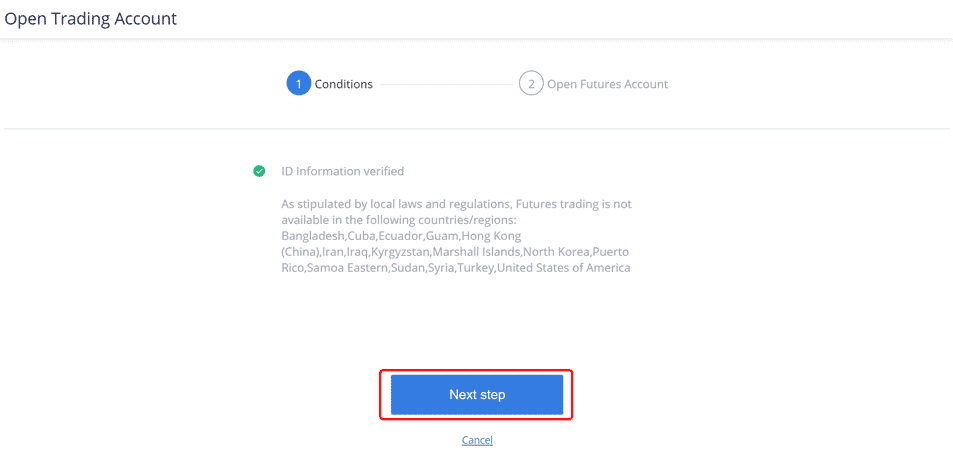

3. Users need to complete Risk Verification first when open trading permission【For ID verification,please check>>>】. Then click “Next step”. Read through the user agreement, accept and submit the agreement. Finishing all steps, users will get access to Huobi Futures and start trading.

4.After finishing Risk Verification, users could check account UID, Account&Security and Fee Rate on the top-right corner.

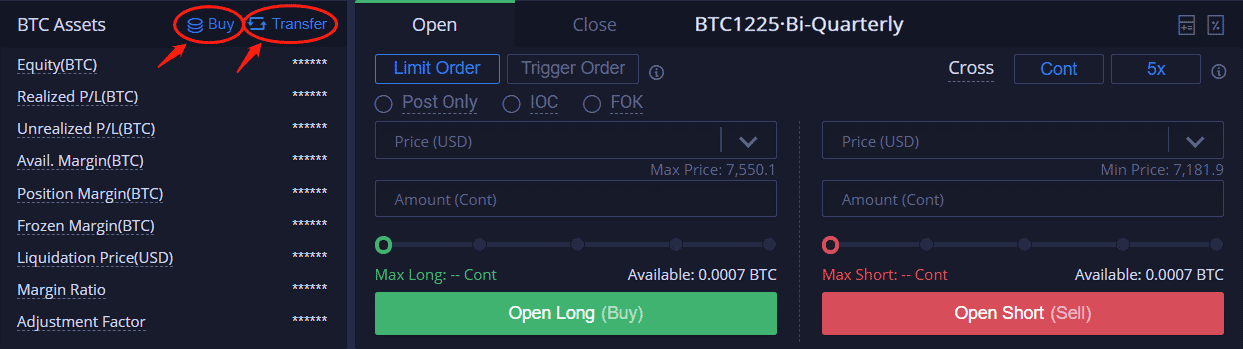

5.Click ‘Transfer’ button as the screenshot shows ( or click the “Assets” button (on the top of the home page), turning into assets page and finding “Transfer” button here). If you do not have assets in your account, please click “buy coins” button, jumping to Huobi OTC. 【How to buy cryptocurrencies?>>>】

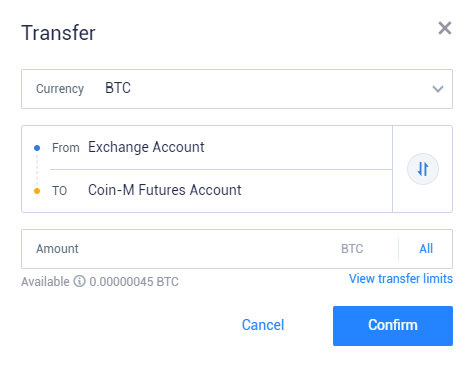

The transfer interface will pop up, where users can transfer assets from "Exchange Account" to "Coin-M Futures Account" by entering quantity and selecting corresponding digital currency. The final step is to click "Confirm".

Notice: Currently, only spot accounts and Derivatives accounts mutual transferring is available.

6. After transferring, users can find the total assets and account equity around the left corner on the top of the home page. Then, users can start to trade on Huobi Futures (if users want to hide their account assets and equity, please click the "eye" icon).

7. Please select the futures types types you want to invest, for example, BTC Bi-Quarterly futures.

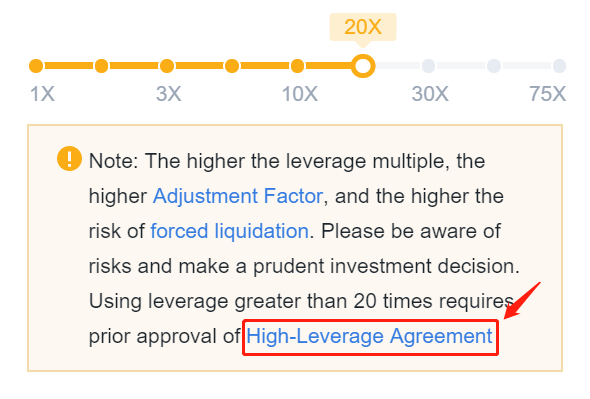

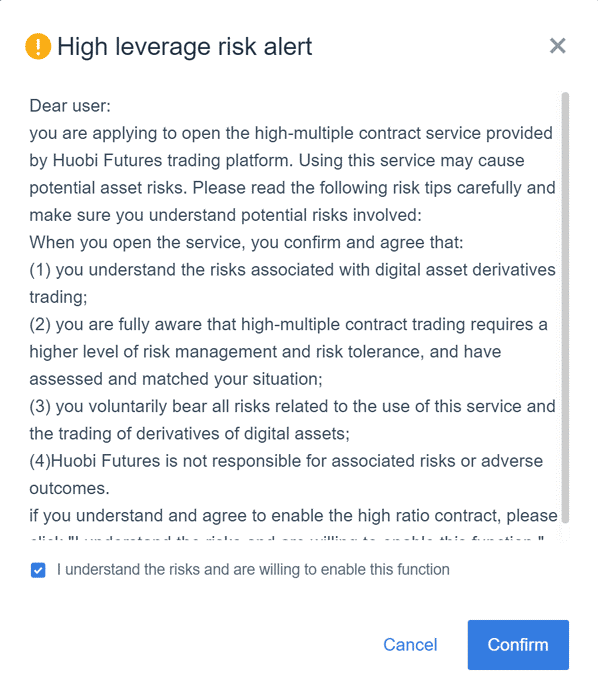

8. Futures supports leverage up to 125x. If users select leverage higher than 20x, they need to read and accept High-Leverage Agreement.

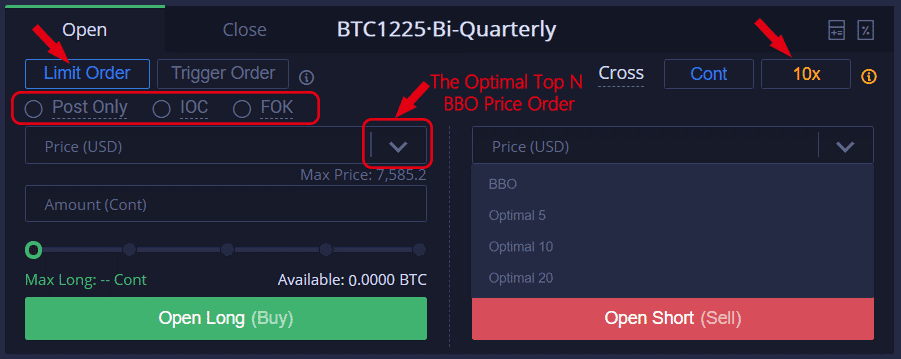

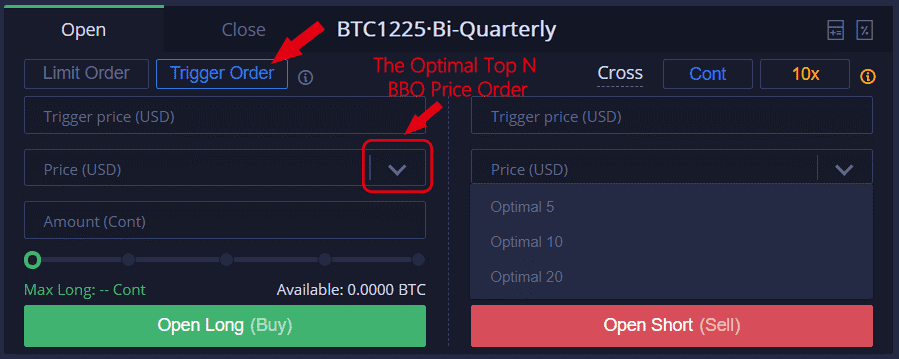

After choosing leverage, users can use Limit order or Trigger order to open positions. If users support a bullish outlook, they could open long. If users are bearish, then could open short.

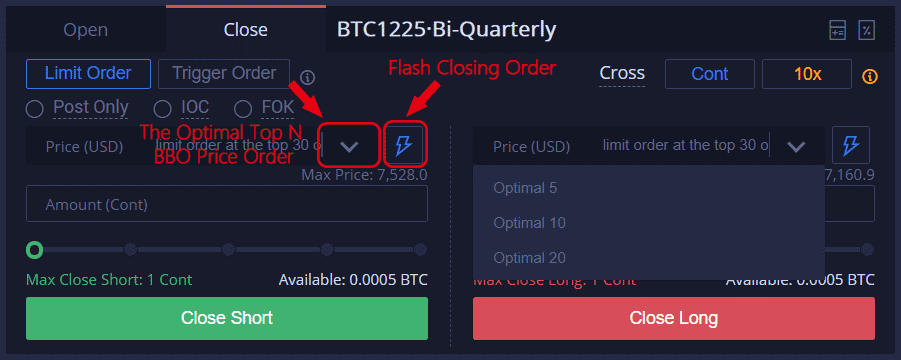

· Limit order: The user needs to specify the price and quantity of the order. They could also choose BBO, Optimal 5 to set price. The limit order specifies the highest price that users are willing to buy or the lowest price that they are willing to sell. After the user sets the limit price, the market will prioritize the transaction at a price that is favorable to the user. Limit orders can be used to open and close positions.The unfilled part is automatically converted into a pending order and waiting for a deal. There are three types of limit order in advanced order. They are “Post only”、IOC (Immediately or Cancel)” and “FOK (Fill or Kill)”. Limit order is default settings. For more,please click【Limit Order Operation Instruction】

· Trigger order:Trigger order is a pre-set order, that users place ahead with an order price and contracts amount (like a limit order), which will only be triggered under specific conditions (a trigger price/trigger). For more ,please click 【Trigger order operation user manual>>>】

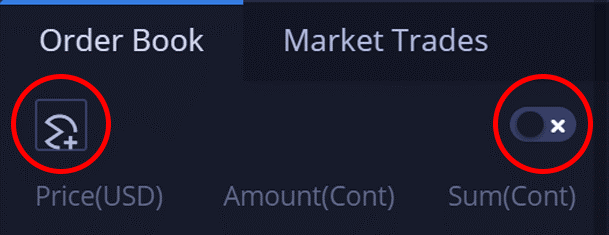

· Taker & Follow a Maker

Follow a Maker’ means that place a limit buy order or limit sell order according to the market price of the user 's selected gear and the amount calculated by Available Assets proportion / Available Close proportion (or the amount in the order book). With the ‘Follow a Maker’ function, you can choose the ‘Post Only’ effective mechanism. The post only limit order option ensures the limit order will be added to the order book and not match with an existing order. If your order is immediately matched with an existing order, your post-only limit order will be cancelled, thus ensures that the trader remains a maker. When the effective mechanism is not selected, it is an ordinary limit order.

Taker refers to the limit buy order or limit sell order according to the market price of the user 's selected gear and the amount calculated by Available Assets Proportion / Available Close proportion (or the amount in the order book). With the “Taker” function, you can select ‘IOC” or “FOK’ effective mechanisms which mean that the unfilled order will be cancelled if they cannot be executed on the market immediately or the entire order will be cancelled if they cannot be fully executed. When the effective mechanism is not selected, the price limit order defaults to ‘always effective’. For more, please read 【Operation instruction on Taker & Follow a Maker】

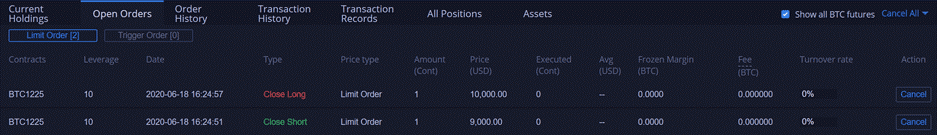

9. Users can find filled orders in Current Holdings, and unfilled orders in Open Orders which can be withdrawn before filled.

10. When come to close positions, users can also select Limit Order or Trigger Order to close long/short positions. 【Learn more about Flash Close>>>】

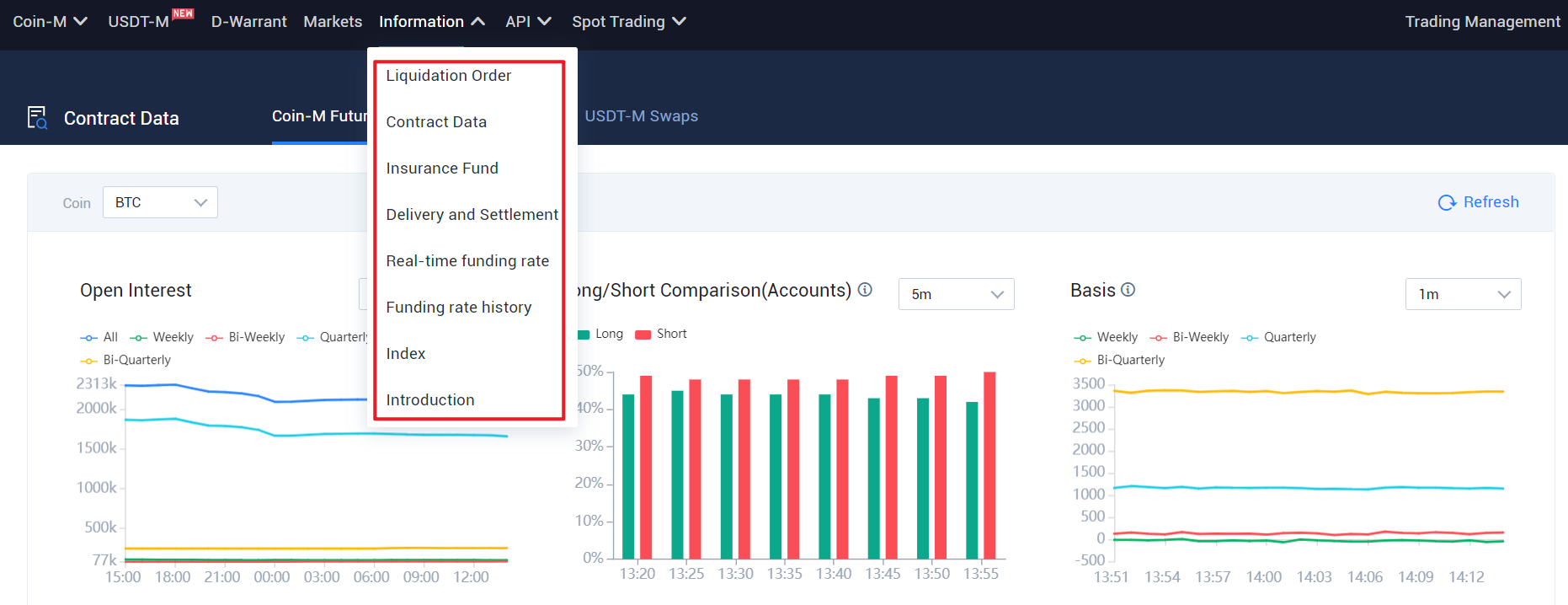

11. Click the “Information” on the left top of navigation bar to check "Contract Data", "Delivery and settlement", "Insurance Fund", etc.

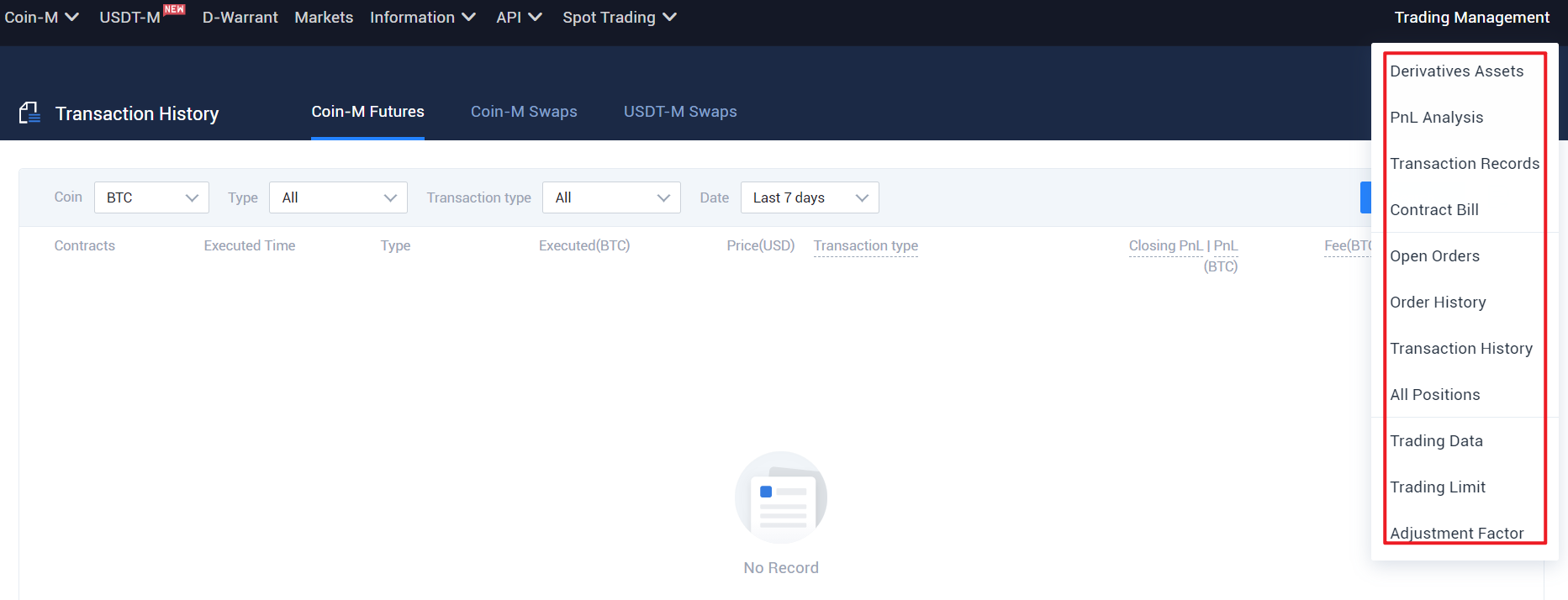

12. On the top right of "Derivatives Assets" navigation page, users could click "Transaction Records" , "Order History" and "Transaction History" etc to check trading data.