“Take-profit and stop-loss order” refers to a position-closing order with preset trigger conditions (trigger price of take-profit or stop-loss order) and price. When the latest price reaches the preset trigger price, the system will place a position-closing order based on the pre-set price and amount, so as to take profit or stop loss. Currently, there are two methods to place a take-profit and stop-loss order:

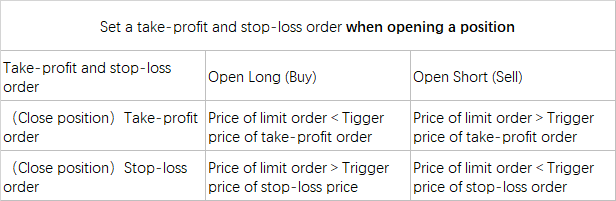

- Set a take-profit and stop-loss order when opening a position: When placing a position-opening limit order, users can set a take-profit order or a stop-loss order in advance or set a take-profit order and a stop-loss order at the same time for the position. When the position-opening limit order is partly or fully filled, the system will place a take-profit and stop-loss order with the preset trigger price and price of the limit order.

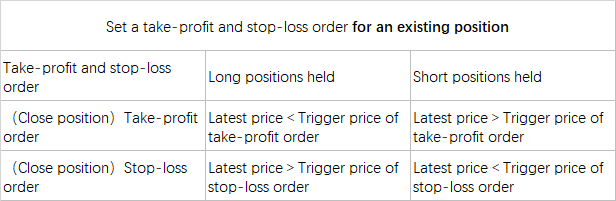

- Set a take-profit and stop-loss order for an existing position: User can set a take-profit order or stop-loss order for a certain position, or set a take-profit order and a stop-loss order at the same time. When the latest price reaches the trigger conditions, the system will place a position-closing limit order with preset price and amount to market.

Notes:

- All take-profit and stop-loss orders are only applicable for position-closing orders. And at most 30 take-profit and stop-loss orders can be set for each contract.

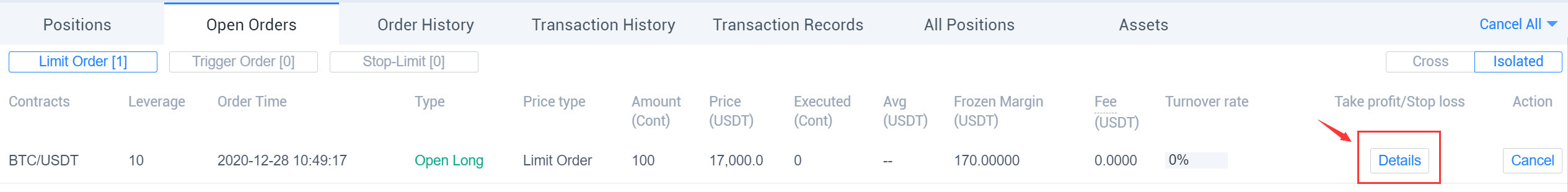

- When a position-opening limit order is partly or fully filled, the status of the corresponding take-profit and stop-loss order is waiting to be placed. After taking effect, the amount of take-profit and stop-loss order equals to the amount of limit order by default, and users could check orders in [Open Orders-Take profit/Stop Loss]

- Positions available to be closed will not be frozen until the take-profit or stop-loss order is triggered, and will only be frozen when the limit order is successfully placed after being triggered. And if the positions available to be closed is less than the quantity entered for the limit order, the system will place a position-closing order based on the actual positions available to be closed.

- The take-profit order and stop-loss order which are placed simultaneously are interrelated. If one is triggered, the other will be cancelled. If a position is 0, the related take-profit and stop-loss order will become invalid automatically.

- The take-profit and stop-loss orders may fail to be triggered due to violent market fluctuations, price restrictions, position restrictions, insufficient margin, insufficient available closing amount, contract in non-trading status, system problems, etc.

- Once the position-closing limit order is triggered, it will be the same as an ordinary limit order, that is, when the selling price is lower than market price or the buying order price is higher than market price, the order will be filled at the optimal price. Please note that whether the order can be successfully filled or not depends on the market conditions. The unfilled limit order can be checked in [Open Orders-Limit Order].

Example 1: Set a take-profit and stop-loss order when opening a position

Tom thinks recently the key support will be near 17,000USDT, so he can buy to open long positions. At this time, he can set a limit order and a take-profit and stop-loss order at the same time.

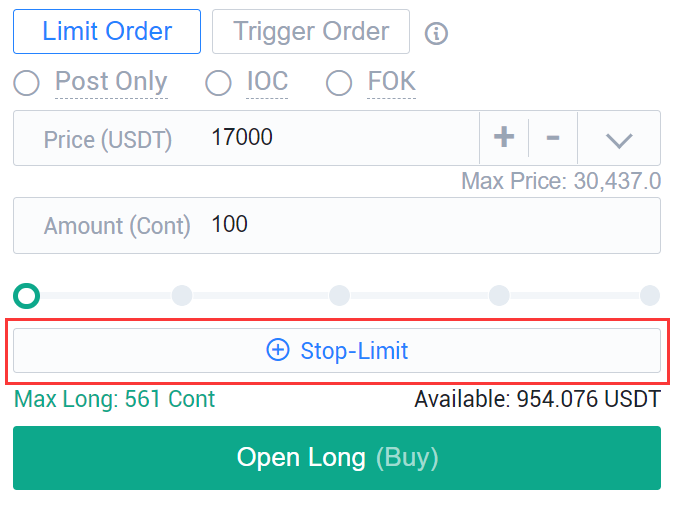

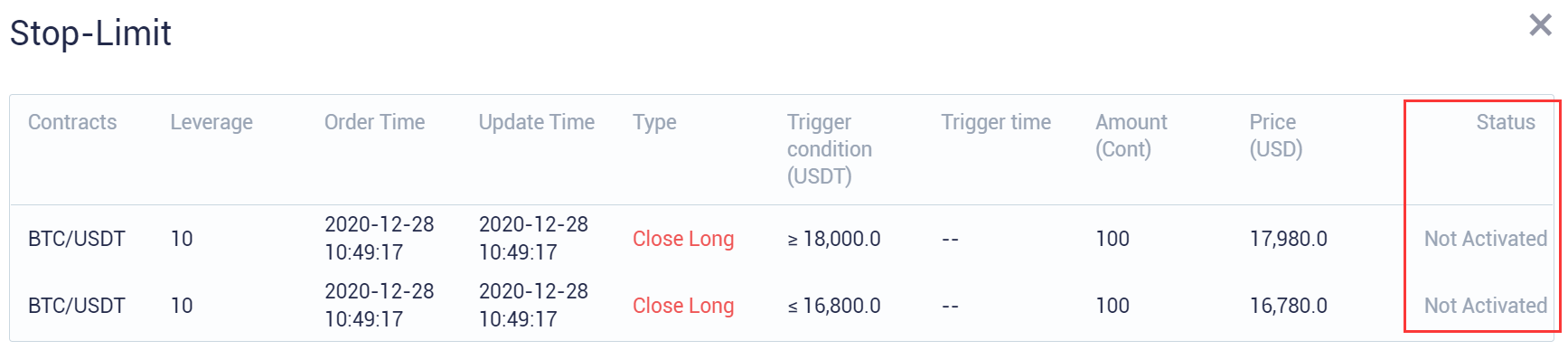

Assume the buying price of limit order is 17000USDT and the quantity is 100 conts. After the limit order is set, click “Stop-Limit” to set a take-profit and stop-loss order.

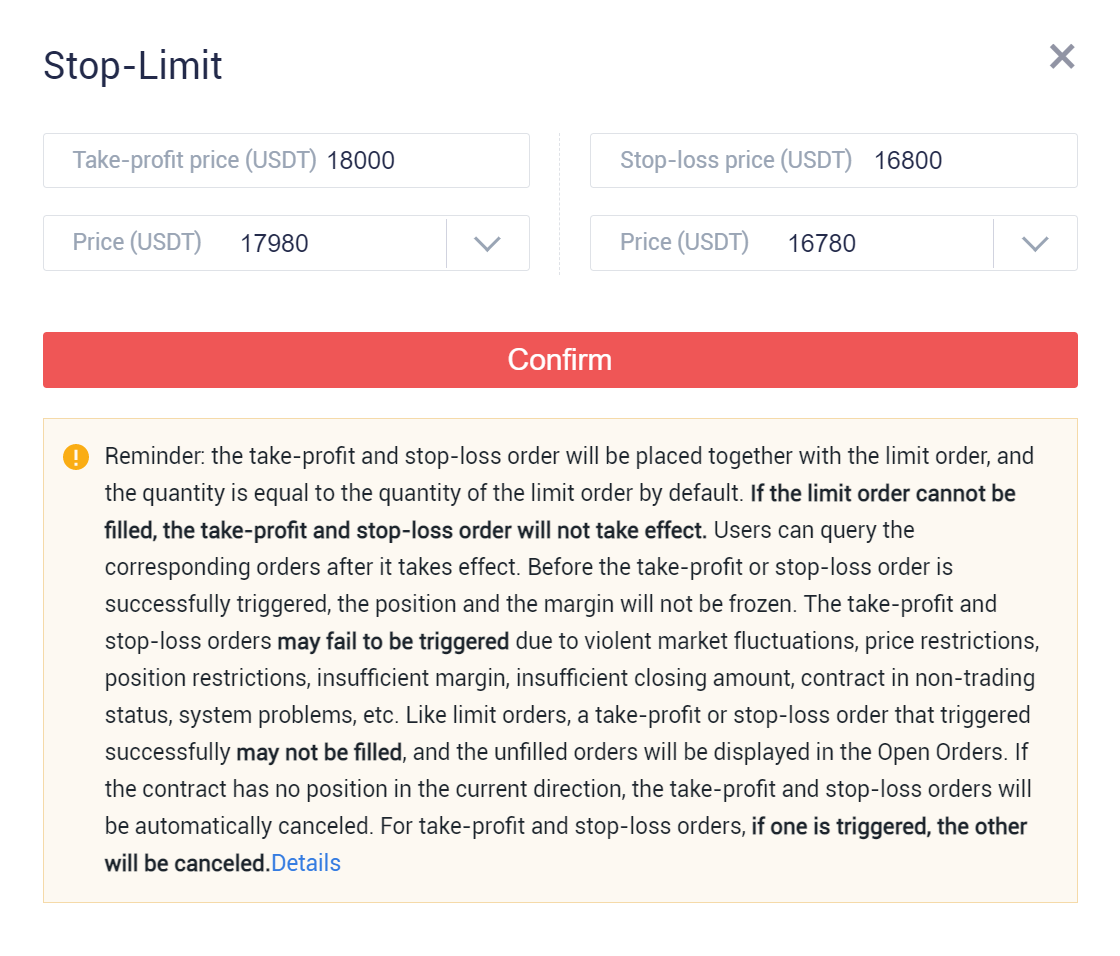

If the BTC price drops to 16800USDT, the support will be weak and the market may fall sharply. To avoid this slump, he wishes to stop loss at the price of 16800USDT. At the same time, he thinks if the price rises above 18000USDT, there might be a price correction, so he wants to take profit at the price of 18000USDT. Then he can choose to set a take-profit order and a stop-loss order at the same time when opening the position.

Notes:

- Users can set either a take-profit order or a stop-loss order, or set both take-profit order and stop-loss order at the same time.

- The take-profit price entered is required to be higher than the position-opening price when buying to open a long position, while the stop-loss price entered is required to be lower. At the same time, the take-profit price entered is required to be lower than the position-opening price when selling to open a short position, while stop-loss price is required to be higher.

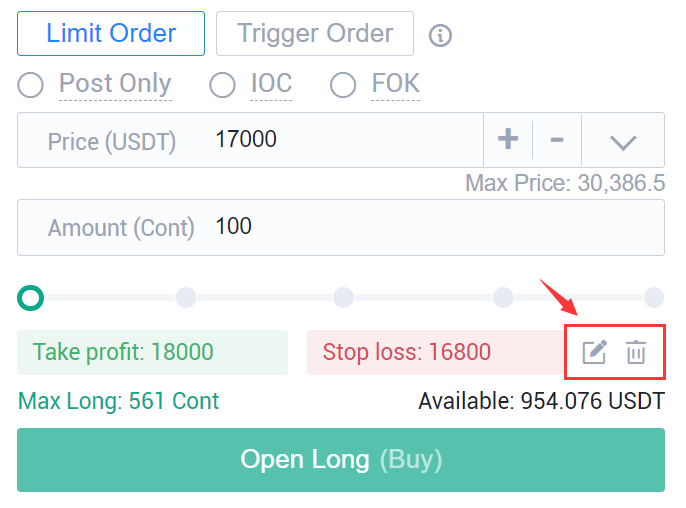

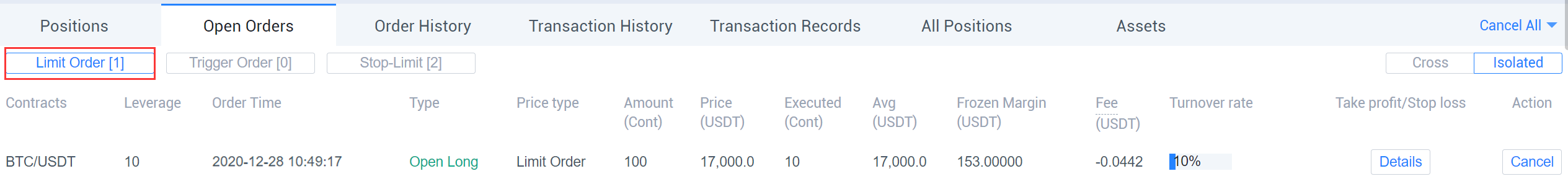

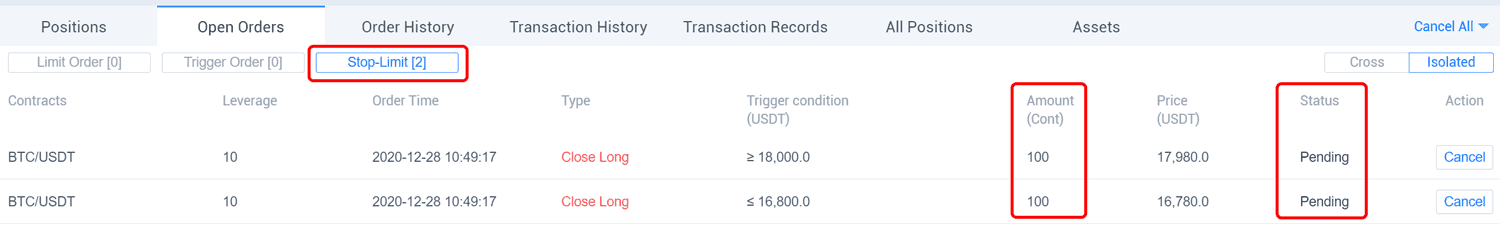

After the order is set, users can click “Open Long” to place an order. Users can check the details of the order and the related “take-profit and stop-loss orders” in [Open Orders-Limit Orders]”. When the limit order is not filled, the take-profit and stop-loss orders will not take effect.

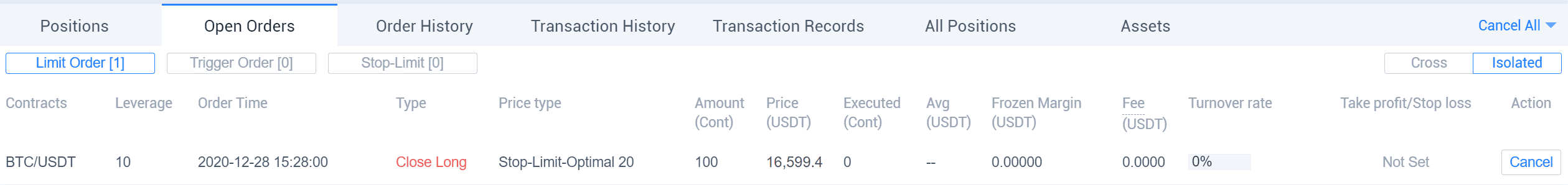

When position-opening limit order is partly or fully filled, the status of related take-profit and stop-loss order will be reverted to “waiting to be placed”. The amount of take-profit and stop-loss order equals to the amount of limit order by default, and users could check the orders in [Open Orders-Take profit/Stop Loss]

Notes:

- If the position-opening limit order is cancelled before the order is fully filled, the related take-profit and stop-loss orders will become invalid at the same time.

- If a user’s position is 0, the related take-profit and stop-loss orders will become invalid automatically.

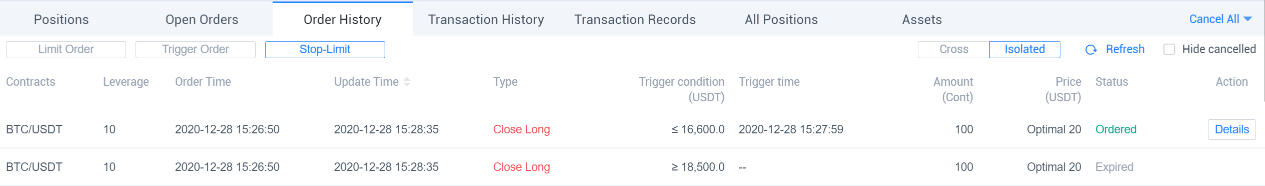

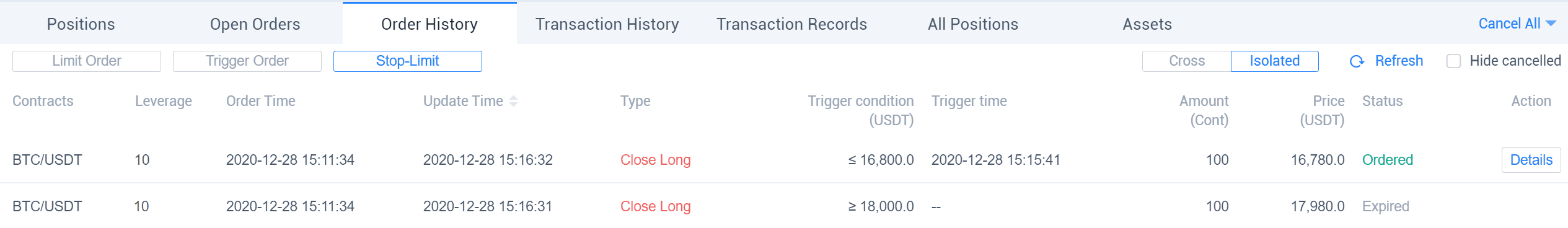

Assume when the latest price of BTC/USDT drops to 16800 USDT, the stop-loss order of the position will be triggered, and the system will place a position-closing order based on the preset stop-loss price, and the take-profit order will become invalid automatically.

Example 2: Set a take-profit and stop-loss order for an existing position

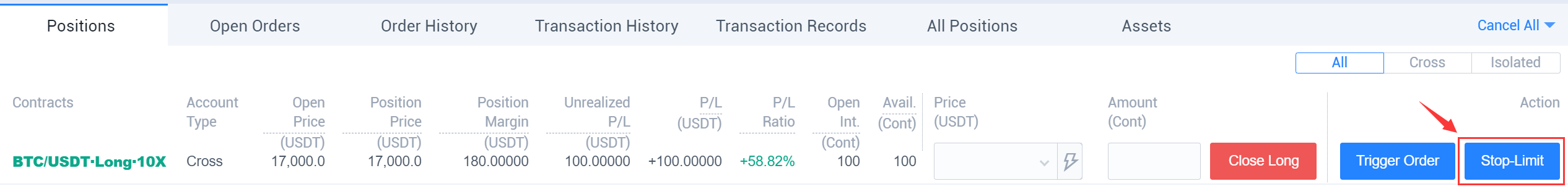

Assume Tom holds a long position of 100 conts of BTC/USDT swaps with an average price of 17000USDT, while the latest market price of BTC/USDT is 18000USDT. If at this time Tom wants to set a take-profit and stop-loss order for the position, there are two methods as below:

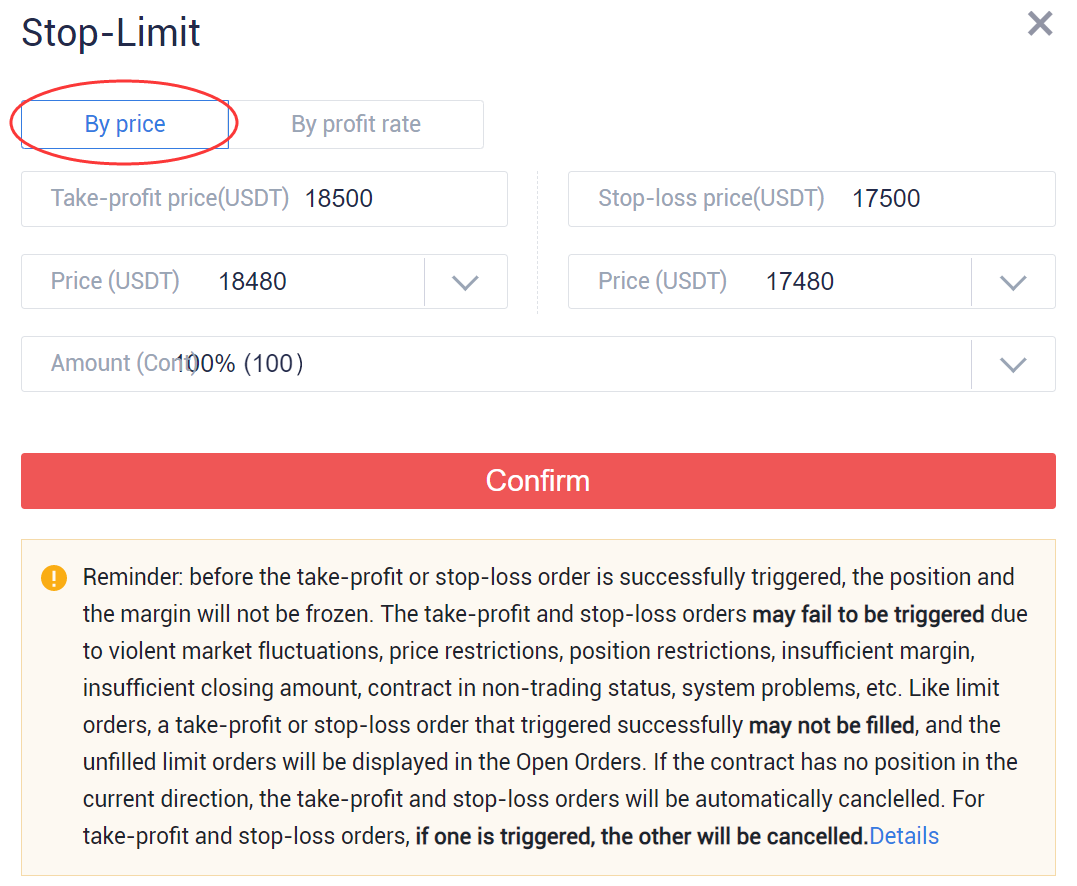

Method 1: set by price

Notes: The take-profit price entered is required to be higher than the latest price when holding long positions, while the stop-loss price is required to be lower. And the take-profit price entered is required to be lower than the latest price when holding short positions while the stop-loss price is required to be higher.

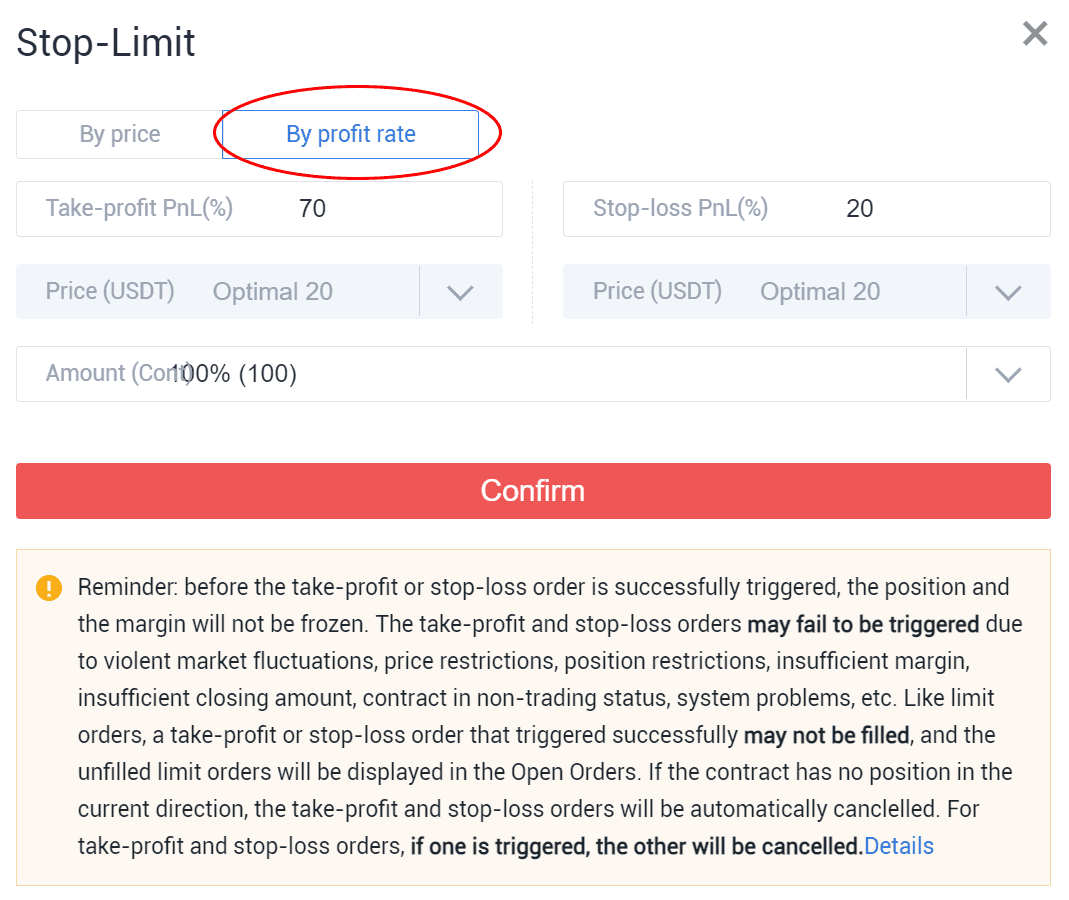

Method 2: Set by profit rate

Notes: The profit rate set to take profit is required to be higher than that of the current long position, while profit rate set to stop loss is required to be lower. And the profit rate set to take profit is required to be lower than that of the current short position while the profit rate set to stop loss is required to be higher.

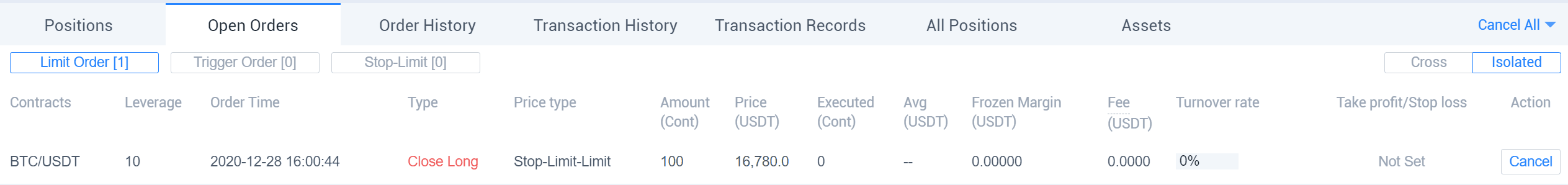

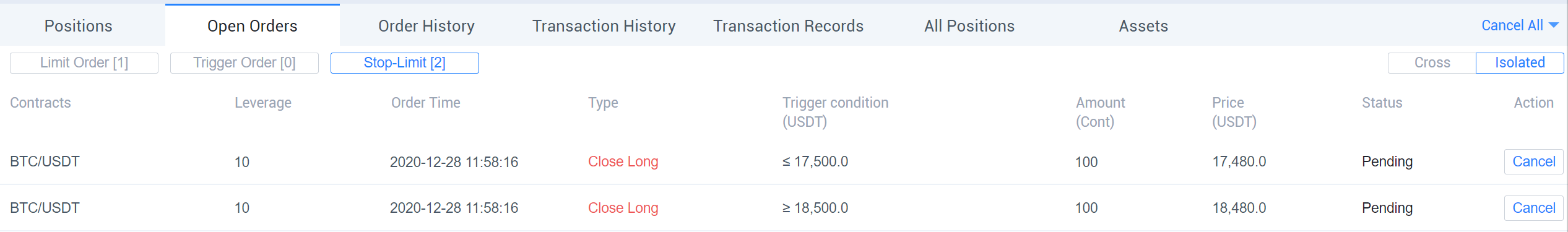

After the order is set, users could check the orders in [Open Orders-Take profit/Stop Loss]:

Note: If a user’s position is 0, the related take-profit and stop-loss orders will become invalid automatically.

When the latest price triggers either a take-profit order or a stop-loss order, the system will place a position-closing order at the preset price, while the other stop-loss or take-profit order will become invalid.